Start your production journey in CSJSEZ

Unlock the potential of CSJSEZ's manufacturing industry.

Enter the program

2-3 month process

Facility Survey

Accompanied by a specialist, we will provide you with comprehensive information on location advantages, prices and other relevant details through on-site consultation.

CDC/CIB Review

Upon confirmation of acceptance by the CIB (Investment Review Board), a "Conditional Registration Certificate" will be issued.

Contract Enforcement

Both the investor and the CSJSEZ shall perform the rights and obligations stipulated in the agreement and provide the necessary documents, including the lease certificate or hard card transfer, to execute the agreement.

Enter completion

Start the process of establishing the business in a standard factory building or subsequently build the necessary factory building according to specific requirements

Tips and Guidelines

Analysis and evaluation

You need to conduct a comprehensive analysis of the investment environment, including the availability of raw materials, infrastructure and production costs.

You will also need to assess the suitability and cost-effectiveness of the investment product and Cambodian policies.

Finally, you will need to identify potential investment sites and conduct on-site inspections of the production location and environment to determine its suitability.

Unrivaled Quality

Newly established businesses must register with the Ministry of Commerce (MoC) of Cambodia. If all documents meet the requirements, the registration permit will be issued within approximately 10 working days. Businesses in Cambodia generally have the following forms.

Companies established in Cambodia

Subsidiaries of overseas companies in Cambodia

Representative office of overseas company in Cambodia.

Ministry of Commerce Online Business Registration

The Ministry of Commerce launched the online business registration service on January 4, 2016.

Please visit KPMG's Cambodia investment fact sheet.

Investment Preparation

You need to prepare the necessary documents for your investment application.

For individual investment, consult with the Cambodia Investment Review Committee (CDC) to find suitable land and factories, and then prepare the materials according to the CDC regulations.

For joint ventures. Find Cambodian partners, negotiate and sign a memorandum of understanding.

Frequently Asked Questions (FAQ)

Land & Factory Buildings

What are the models for land leasing and procurement in the SEZ?

Currently there are three land leasing/purchasing methods in the Changsan Economic Zone:

1. Short-term lease with varying prices based on lease duration and land area

2. 50-year long-term lease (customer's preferred choice)

3. Land title transfer

Can the land be transferred to the buyer?

Title transfer is possible but requires buyer to pay 4% stamp duty and possess local household registration in Kep Province, with specific amounts subject to Kep government requirements.

Non-Kep residents can obtain land through:

Method 1: Trust (recommended China Trust)

Method 2: USD 200k+ investment for Kep residency

Method 3: Kep-registered legal entity

Land, factory rentals Lease rental unit price?

Land price: Phase I USD, with planned quarterly increases of , lease term years.

Factory rental price: USD- USD/sq.m/month, varying based on factory condition and lease duration.

What are the advantages of the SEZ?

1. Changsan Economic Zone has superior infrastructure compared to surrounding industrial areas, featuring dual main roads, dedicated power grids, landscaping, plus fire trucks and one-stop service offices.

2. The zone's strategic location offers advantages - only 30km from Muping Pass and 15km from Long'an Pass, reducing import/export transportation costs.

Can land that has been leased be used for loans?

Land with a 50-year lease; the lessee can apply for a local loan with the Long Term Lease Certificate.

What are the rates for management fees, electricity, etc. for theSEZ?

Management fee: USD/m2/month

Electricity fee: USD/KWH (See Appendix 1: Charges in the CSJSEZ)

Electricity

Is there enough electricity in Cambodia?

The zone receives dedicated power supply from Chiba Station connected to Vietnam's grid, ensuring no blackouts or power shortages.

Environmental Protection

Is there an occupancy threshold for polluting industries, Cambodian government, CSJSEZ?

Cambodia has a relaxed policy on polluting industries, and there are no laws restricting polluting industries. A sewage treatment plant is set up in the CSJSEZ to ensure that sewage discharge meets the standards, and rainwater and sewage separation are planned in advance. At the same time, the CSJSEZ has outsourced companies with solid waste treatment qualifications to handle solid waste in the special zone in compliance with regulations.

Entry threshold: The CSJSEZ will assess the CDC regulations and the actual conditions of the manufacturers, and is also relatively relaxed.

Labor & Taxation

How is the labor market in Cambodia? Are general laborers, clerks, and translators easy to recruit?

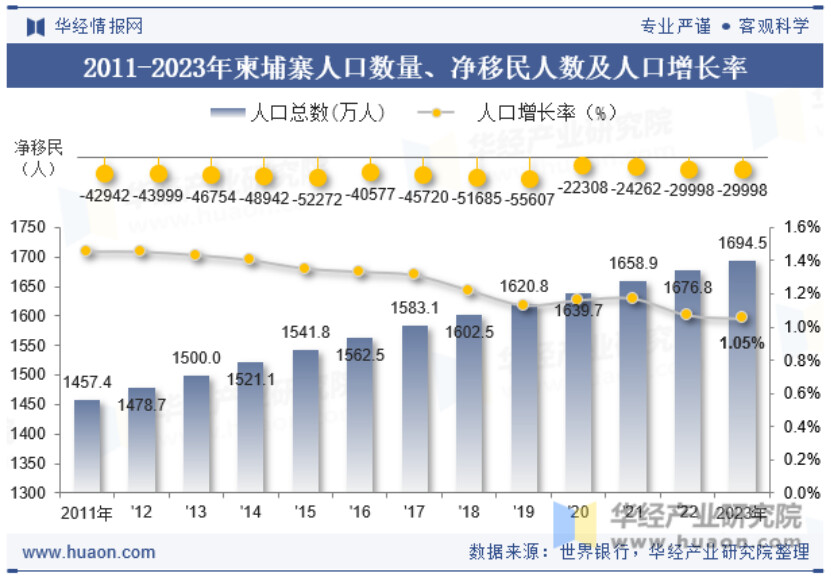

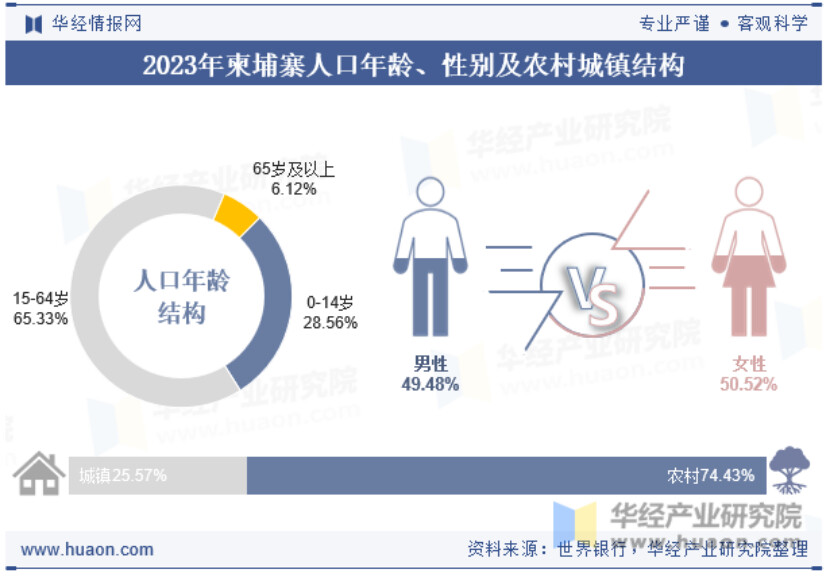

1. Workers: Kep's median age is 25.6 (vs China's 38.4), with 75% population under 40. (Appendix 2: 2022 Kep demographic structure).

2. Staff: Chiba University (20km from the zone) provides main office personnel through close cooperation.

3. Translation: Over 100 Chinese educational institutions in Kep with 100k+ learners (zone provides recruitment support).

How are employee pay, benefits, social security, and overtime calculated?

Compensation: 2023 base salary of US$, 2024 base salary of US$ (increase only %/year)

Benefits: USD = USD transportation allowance + USD lunch allowance

Some factories: USD full attendance + USD health allowance

Social security: USD per person per month

Overtime pay: 100% for overtime during weekdays, 100% for overtime on Sundays, and 100% for overtime on statutory holidays (Cambodia has only one day off on Sundays)

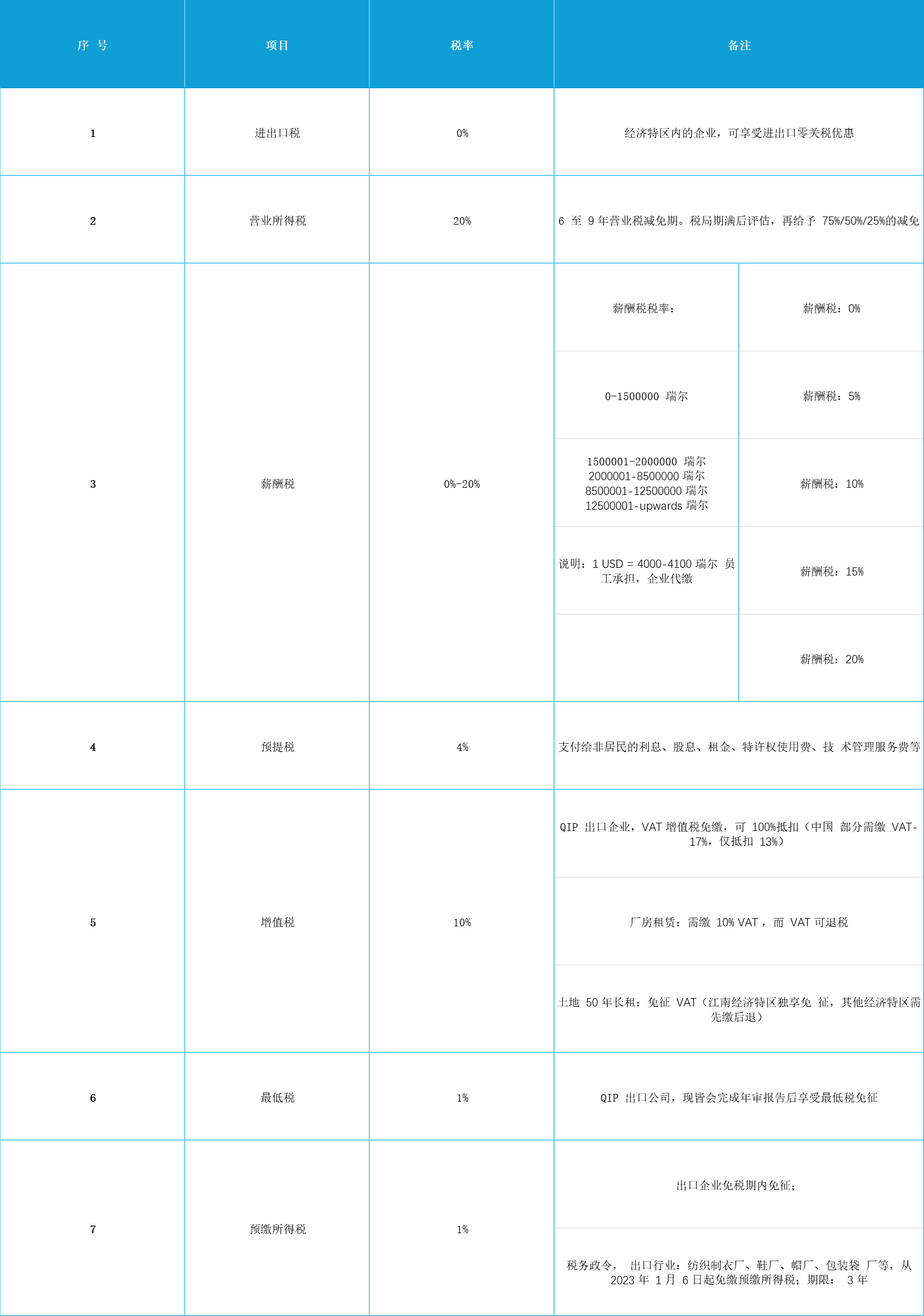

What are the types and rates of taxes in Cambodia? What benefits are available to investors?

1. In the Sino-US trade war, the United States increased tariffs on Chinese exports by 25%, while Cambodia did not.

2. Cambodia exports to China, South Korea and Japan and enjoys zero tariff or tax treatment lower than the most-favored-nation tax treatment.

3. Cambodia exports to Europe and the United States and enjoys quota exemption and tariff reduction. The above can be checked by the client based on the product HS Code for specific import item tariffs.

4. Cambodia has 0 import and export tariffs and is exempt from business tax for 6-9 years. (For details, please refer to Appendix 3: Cambodia's main taxes and tax rates).

Freight and trade

The total cost of the factory's import and export trailer fees, customs clearance fees, etc. through the port of Ho Chi Minh?

The CSJSEZ provides one-stop services, including customs declaration, customs clearance, towing and other services.

Cambodia's trade advantage?

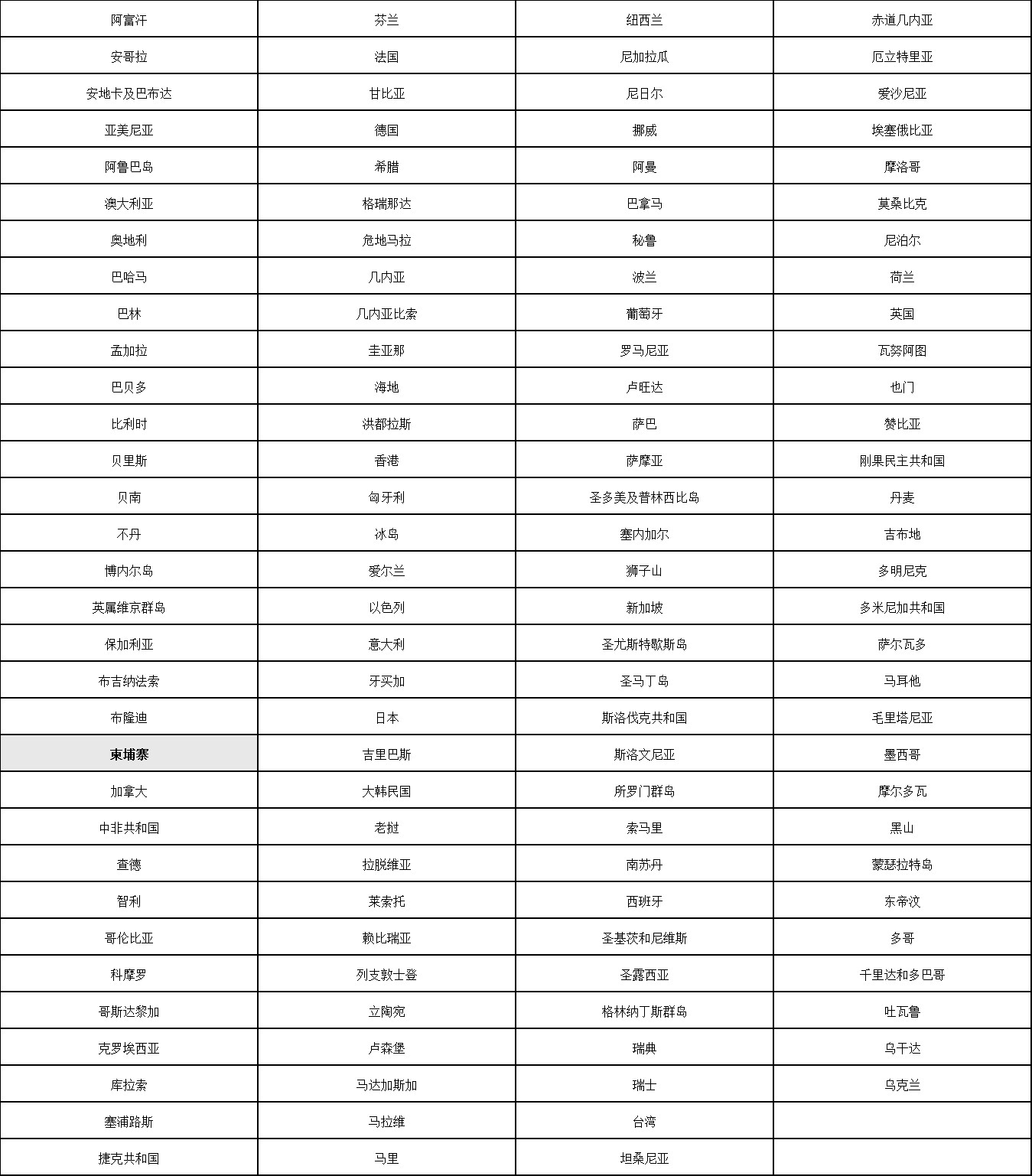

Kampong Glam is designated as a TAA-compliant country (excluding China, Vietnam, and Thailand) (see Appendix 4 for details)

According to the U.S. Trade Agreements Act (TAA), products supplied to the U.S. federal government through the GSA Schedule must be manufactured in the U.S. (U.S.-made) or in designated countries (designated-country end products).

Registration and Planning

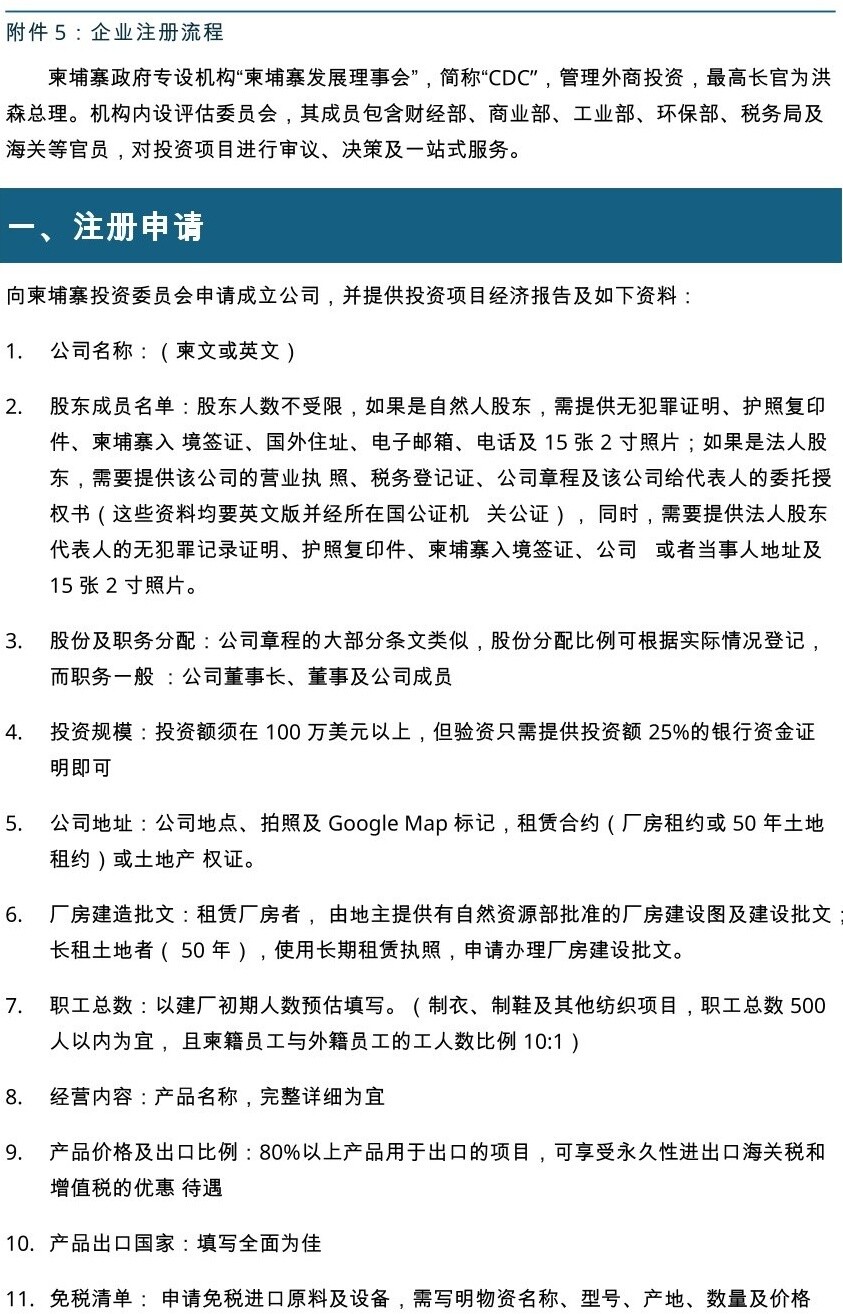

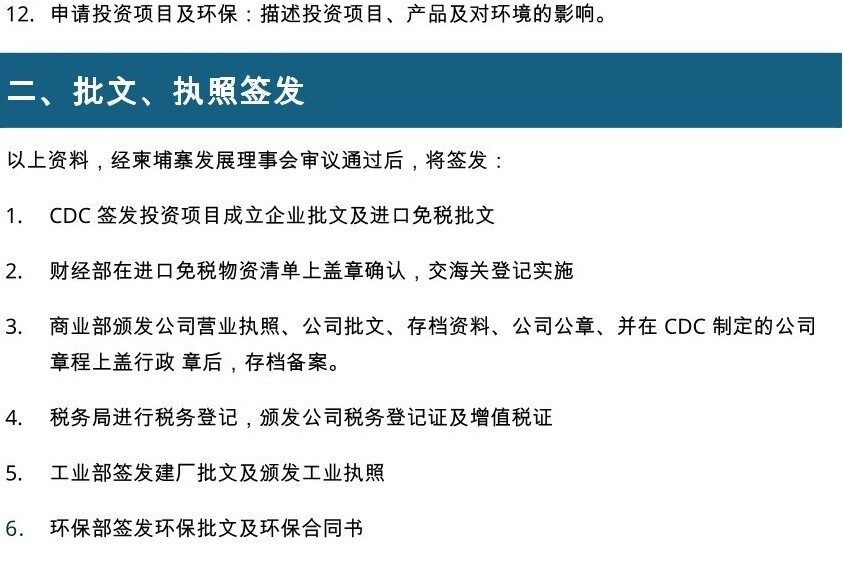

What is the cycle and process of business registration in Cambodia? How to remit investment capital from mainland China to Cambodia?

Enterprises submit registration applications to the Council for the Development of Cambodia, which will accept the application through one-stop service and complete it within 45 days.

Registration process, please refer to Attachment 5: Enterprise Registration Process

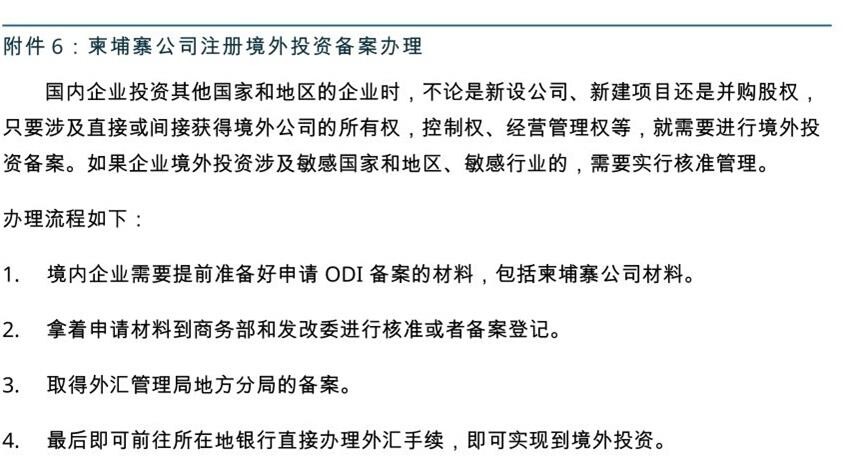

Investment remittance, please refer to Attachment 6: Cambodia Company Registration Overseas Investment Registration Processing

Future plans for the park?

Building the Greater Bay Area Economic Zone 2.0, integrating commercial, residential, medical, and educational hubs, along with a new high-tech industrial park guided by ESG principles and carbon reduction goals.